[ad_1]

- CAD declines for third month in a row.

- Analysts attribute decline to administrative measures.

- Decline in petroleum imports main reason behind decrease.

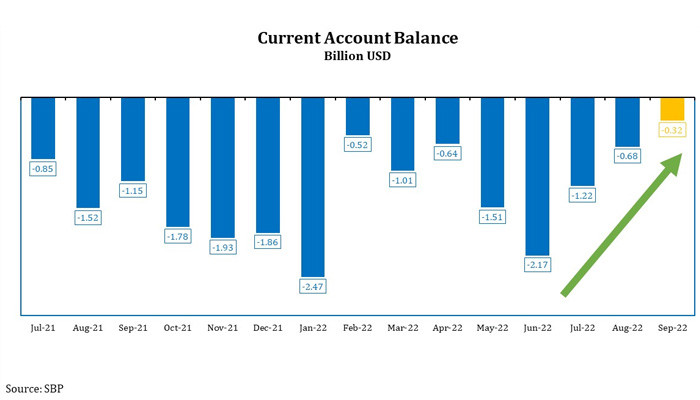

KARACHI: Pakistan’s current account deficit narrowed 37% to $2.2 billion in the first quarter of the current fiscal year as a result of lower imports and a rise in exports, the central bank data showed on Wednesday.

Exports of goods increased 5% to $7.6 billion in July-September FY2023 while imports of goods fell 8% to $16.1 billion.

“In September, the current account deficit (CAD) declined for the 3rd month in a row. It fell to $0.3 billion, less than half the level in August. In Q1FY23, the CAD has fallen to $2.2 billion from $3.5 billion in Q1FY22, mainly reflecting a decline in imports,” the SBP said on its official Twitter handle.

Analysts said the decline in the current account gap was due to falling demand caused by administrative measures and lower energy imports. The SBP also kept a strong check on imports.

Fahad Rauf, the head of research at Ismail Iqbal Securities, said the first quarter current account deficit number is slightly better than expectation. “The decline in petroleum imports is the main reason for reducing the deficit,” Rauf added.

The SBP expects the current account deficit to be around 3% of the gross domestic product during the current fiscal year.

The impact on the current account deficit is likely to be muted, with pressures from higher food and cotton imports and lower textile exports largely offset by slower domestic demand and lower global commodity prices, the SBP said in its latest monetary policy statement issued on October 10.

“Looking ahead, the floods are likely to result in greater need for some agricultural imports such as cotton and a few perishable food items. At the same time, exports of rice and textiles are likely to be negatively affected,” the SBP said.

However, these adverse impacts could to a large extent be offset by downward pressures on the import bill from lower domestic growth and falling global commodity prices and shipping costs.

In addition, as experienced after previous natural disasters in Pakistan, the impact on the current account could be further cushioned by international assistance in the form of current transfers, it added.

Given secured external financing and additional commitments in the wake of floods, foreign exchange reserves should improve through the course of the year, according to the SBP.

[ad_2]