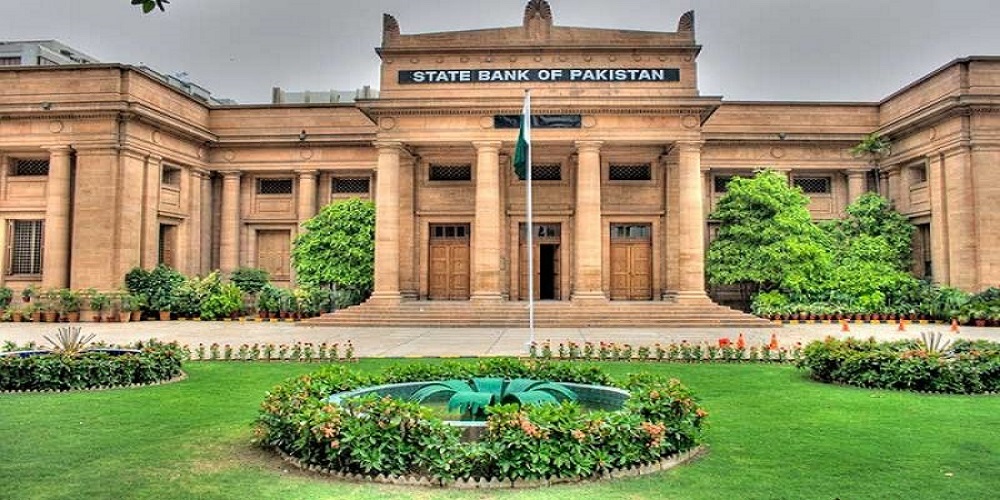

State bank of Pakistan announced increase in the concessional financial limits for women entrepreneurs. Financial inclusion of Rs. 1.5million is increased to Rs. 5 million under its Refinance and Credit Guarantee Scheme for Women Entrepreneurs. SBP took this step to encourage women to participate in economy.

This decision was taken in accordance with the women’s important role in the economy yet they have insufficient finances to start their business. The decision is implemented with government’s policy to revive economic activity in the country. To support this SBP’s objective, the government is prioritizing steps to improve access to finance for women interested in start-ups.

SBP had introduced Refinance and Credit Guarantee Scheme for Women Entrepreneurs initially in August 2017 to promote financial development in the country. Under the government scheme, scope was expanded to the whole country.

As SBP provides financing to participating institutions like commercial banks (e.g; HBL, UBL, MEEZAN, etc) at 0% mark-up. Same like that financing will be provided to women entrepreneurs. The commercial banks further can lend these borrowings of SBP to end-user (women entrepreneurs) at maximum of 5% rate. Moreover, in case end-user defaults, SBP also covers 60% of risk coverage to financial institutions.

This enhancement of finances to women entrepreneurs will benefit the women in society interested in starting their small business. Hence more and more women can avail this opportunity and expand the scope of business under this scheme of concessional financing.